Views: 267

Summary

- Li Lu manages $3.7 billion for Himalaya Capital and has a close friendship with Charlie Munger.

- For those without a background that would lead to competence in understanding Asia, analyzing Lu’s trades can provide a head start in navigating the Chinese and other Asian markets.

- Although Li Lu is most known for his BYD investment, he has also invested in CRRC, Ilsung Pharmaceuticals and Korean Preferreds.

- Understanding the rationale for these investments and following it is a wise long-term strategy as periods of wide differences in price and value are likely.

[Editor’s note, June 10, 2016: Author has corrected shareholding attribution to Mr. Lu since original publication.]

Had Li Lu never decided to become an investor, he would still have had an eventful life. His parents were sent to labor camps during the Cultural Revolution in China, a movement designed to re-assert the influence of Mao. Lu was shuttled between families until he was 10. At the age of 23, he became a student leader in the protests of the Chinese government in Tiananmen Square. The protests were instigated by the resignation and death of Hu Yaobang, a liberal reformer whose outspokenness and willingness to attack corruption had made enemies. What began as a remembrance became a protest. After the government sent the military to disperse the protesters, Li Lu was the eighteenth most wanted activist by the Chinese government. An operation that involved both the US and UK intelligence agencies allowed Lu, along with many others, to escape China through Hong Kong after the protests. Lu wrote a memoir of this time titled Moving the Mountain and a 1994 documentary was produced with the same title.

After making it to the United States, Li Lu enrolled in Columbia University where he earned three degrees by 1996, including joint MBA and Law degrees. According to the foreword to the Chinese edition of Poor Charlie’s Almanack that Lu wrote, Charlie Munger and Li Lu met through a mutual friend (the Wall Street Journal reported that the mutual friend was the wife of Ronald Olson). After a long conversation over Thanksgiving in 2003, Munger convinced Lu to reorganize his investment fund into one that closely mirrored the early partnerships that Buffett and Munger ran. This would have involved insisting on long-term commitments from investors and rather than charging fees on assets, charging only for performance above a threshold. Munger also invested a substantial part of his family’s money in the fund.

Most of the world came to know of Li Lu through Berkshire Hathaway’s investment in BYD during the fall of 2008. Lu had invested in BYD as far back as 2002 and introduced Munger to the company, who asked David Sokol to travel to China and investigate. Berkshire ultimately invested $232 million in BYD in the fall of 2008. That investment is worth a little less than $1.4 billion, a compounded return of about 26% over close to eight years. 世界上大多数人都是通过伯克希尔哈撒韦公司在2008年秋季投资比亚迪而认识李录的。李录早在2002年就投资了比亚迪,并将该公司介绍给芒格,芒格邀请大卫·索科尔(前伯克希尔高管)前往中国进行调查。伯克希尔最终在2008年秋季向比亚迪投资了2.32亿美元。这项投资的价值略低于14亿美元,近八年的年复合回报率约为26%。

Li Lu is a difficult investor to follow, otherwise his investments are likely to have been more widely disseminated than they have been. His investment firm, Himalaya Capital, currently has $3.7 billion in assets under management, but since he primarily invests in Asian companies he is not required to disclose his investments to the SEC on a form 13F. The only way to know what Lu has bought or sold is when Himalaya reaches a threshold where the local regulators or stock exchanges require the disclosing of an investment. In the United States and many other countries this threshold is 5%. 李录是一个很难跟随的投资者,否则他的投资可能会比以前更广泛地传播。他的投资公司喜马拉雅资本目前管理着37亿美元的资产,但由于他主要投资于亚洲公司,因此他不需要在13F表格上向SEC披露他的投资。知道李录购买或出售什么的唯一方法是当喜马拉雅达到当地监管机构或证券交易所要求披露投资的门槛时。在美国和许多其他国家,这个门槛是13%。

There are many reasons to make the effort to learn from Li Lu. Aside from his remarkable life, track record, and close association with Mr. Munger, Lu has competencies that include navigating the peculiarities of Asian investing. Since the rise of Asia in the world economy is not going to reverse and I am not comfortable that I have any competence in understanding markets through most of Asia, learning from Li Lu makes more sense than just about any other starting point. 努力向李录学习的原因有很多。除了非凡的生活、业绩记录和与芒格先生的密切联系外,李录先生的能力还包括驾驭亚洲投资的特殊性。由于亚洲在世界经济中的崛起不会逆转,而且我对自己有任何能力了解亚洲大部分地区的市场感到不舒服,因此向李录学习比任何其他起点都更有意义。

Although it cannot be guaranteed what Mr. Lu currently owns, analyzing current and past investments he has made can still provide worthwhile insight.

To have a better understanding of Lu’s likely thought process as he makes investments, I would first like to review Lu’s past comments on his investing philosophy before moving on to taking a look at some companies he has invested in.

Investment Philosophy

As explained to Bruce Greenwald in 2010, Lu’s philosophy does not materially differ from other value investors. He speaks of having a margin of safety, thinking of a stock certificate as a share in a business, and understanding your circle of competence. He additionally speaks about the intensive research he does on companies and their competitors prior to and after investing. These are very simple concepts. Of course, the challenge is in their application.

The best distillation of how Lu thinks broadly that I have found was in a talk at the Business School at Peking University in the Fall of 2015 where he discussed whether value investing was applicable to the Chinese market. The Guanghua School of Management where he spoke is one of the few business schools in the world to teach a course on value investing. The translation of the speech is not terrific because all of the ones available are literal translations, but what it lacks in the precision of its translation is made up for in the quality of its ideas. The concepts that Li Lu discusses are such simple ideas, but that does not mean that they are not worth returning to. I emphasize that because I read through the concepts and there isn’t one that is foreign to anyone with a basic understanding of finance or economics. The value is in the synthesis.

Lu starts by considering why over the last few hundred years economic growth has exploded. For millennia, economic growth was close to zero and the size of the world economy was determined by nothing more than the size of the population. If population growth increased, then strains were placed on resources and death and misery increased, leading to a lower population. This is what we would call a Malthusian trap. Although Western Europe started to pull ahead from the rest of the world around 1500 through the development of scale in agriculture, it was clearly the Industrial Revolution that decisively ended the Malthusian trap for civilization. Lu cites capitalism and technology as the underlying reason for this explosion of growth. Previously 1+1 had to equal 2, but with trade making both parties better off, 1+1 could now equal more than 2. This is basic economics, but the result of it was to unlock the power of compounded gains on the economy at large. He also notes that inflation is a likely outcome of a free market economy. This is so because in order for banks to attract savings they are unlikely to offer a nominal rate below a lower bound. To encourage investment through a lower real rate of borrowing, then, it makes sense to have a modest amount of inflation.

These facts – a market system that allows for compounded growth in the economy and the likelihood of persistent inflation – are the primary factors that have caused equities to outperform other asset classes over a long-time horizon. Lu relies on Professor Jeremy Siegel’s statistics on the performance of various asset classes since 1800. The real return on the US stock market has been 6.7% versus 3.5% for bonds and 0.5% for gold. Lu clearly believes that so long as a market system of exchange is in place, this relationship should hold true – although the long run can sometimes be very long in materializing as Lu notes the periods between 1966 and 1982, and 2000 and 2012 when the US stock market produced negative real returns.

The next logical question to ask is whether or not a reliable return is available to investors above that of market indexes. From experience, Lu says that value investing is the only means available to reliably beat an index and states that there are four key principles of value investing: equities represent ownership in a business, markets tell you the price of assets and not their value, requiring a margin of safety, and the importance of understanding your circle of competence. This is a simple system that has produced very good returns in western stock markets. Is there reason to think it should work in China?

There are two possible reasons why someone might propose that this system of investing is unlikely to work in China. The first is the amount of influence the government has on the market system in China as well as individual companies. The second is that few people practice value investing in the Chinese market – most are retail speculators – which can cause a divergence in price and value for a very long time. Lu does not believe that these factors will permanently inhibit the success of value investing. It is true that the government in China has fewer limitations than Western governments and also has large stakes in many Chinese companies. But, is there a realistic likelihood that China will abandon the market reforms which have taken place there? Lu argues no. Markets become more efficient through greater scale so that if multiple markets exist the largest market is likely to become the only market. The world today could be thought of as a gigantic marketplace and the addition of so many producers and consumers to the market since the collapse of the Soviet Union and the reforms in China have made the world as a whole more prosperous. None more so than China. No alternative exists for China to increase its wealth and power than to participate in this global market. To choose any other path would be a desire to fail and Lu succinctly states that the chance of China leaving the common market is “almost zero.” That being the case, the general outline of long-term market performance should apply to China – this is, since the fundamental conditions in the United States and Western Europe that produced the best long-term returns in equities are present in China, the relationship should apply to China as well. The experience to date corroborates this viewpoint. Between 1991 and 2014, the Chinese stock markets have produced returns of 10%-11%, outpacing other asset classes just as in the United States.

Lu also contends that not only is value investing possible with a large amount of speculation in the market, but that those who know what they are doing will find their long-term experience enhanced by finding equities that are more likely to deviate from their underlying value so long as they are patient enough to realize it. He says (I’m paraphrasing from a literal translation): “I think that value investing can not only be applied in China at its current immature stage, but value investing has a greater advantage in China because of it… Prices and intrinsic value often diverge massively… if you adhere to a long-term value investment strategy, your chance of success is high.”

Finally, Lu points to financial reforms underway in China as playing a large role in eventually closing the gaps between price and value that exist. Many of these reforms will allow foreigners to more easily invest in the Chinese stock market and it seems likely that the capital markets in China will gradually look more and more like Western markets, as Hong Kong already does.

Individual Investments

CRRC (01766.HK)

As of April 2nd, Himalaya Capital owns almost 268 million H shares of CRRC Corporation, the China Railway Rolling Stock Corporation. That is equal to about 6% of CRRC’s H shares or nearly 1% of the total company. At today’s price of HKD 7.26 the investment is worth about US$250 million. That is a significant amount as it would be equal to 7% of Himalaya’s capital. Close to 57% of the company is owned by the government. Rolling stock refers to vehicles used on a railroad. 截至2016年4月2日,喜马拉雅资本持有中国中车股份有限公司近2.68亿股H股。这相当于中国中车H股的6%左右,或占公司总数的近1%。以今天的7.26港元价格计算,该投资价值约为2.5亿美元。这是一个相当大的数额,因为它相当于喜马拉雅资本的7%, 接近政府所持有股份的57%。机车车辆是指在铁路上使用的车辆。

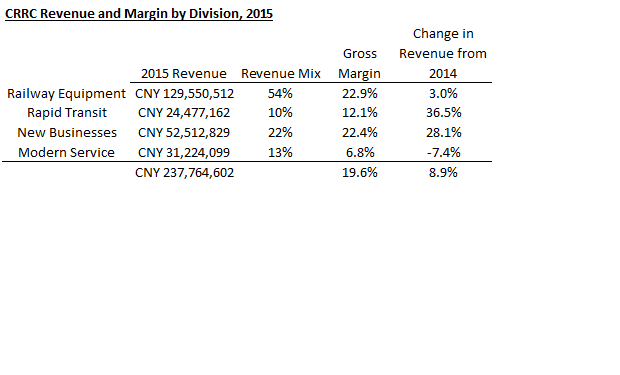

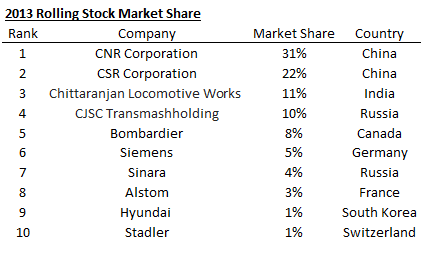

CRRC was formed in 2015 from the merger of CNR (the China North Locomotive and Rolling Stock Corporation) and CSR (the China South Locomotive and Rolling Stock Corporation) to form the largest locomotive manufacturer in the world. Last year more than half of revenue came from the railway equipment business which manufactures multiple unit trains (trains that pull multiple units through a single electric or diesel engine), locomotives, passenger trains, and freight wagons. Rapid transit contributed 10% of total revenues (this is primarily metros/subways), new businesses for 22% and the service (finance and logistics) business for 13%.

Source: 2015 Annual Report

About 89% of revenue last year was the result of sales in mainland China. For the time being, CRRC is heavily dependent upon the strength of the Chinese economy and the desire of China to invest in rail infrastructure. The merger between CNR and CSR essentially gave CRRC a monopoly on the Chinese market. But, the true rationale for the merger was likely to increase competitiveness beyond China as CSR and CNR were frequently bidding against each other. Despite little time passing, that increased competitiveness seems to be occurring. Last year business in mainland China increased 4% while international business increased 66%.

The NY Times reported on the company’s winning the Boston metro business last September. The legacy CNR Corporation actually won the business prior to the merger, but the details on the competitive situation that the article gives are striking. Outside of CSR and CNR, Bombardier (OTCQX:BDRAF) (OTCQX:BDRBF), Hyundai Rotem and Kawasaki Rail Car were the other bidders. CNR’s proposal included local manufacturing jobs as well as a price half of what Bombardier was able to quote. Also pointed out is that many local authorities are locked into relationships because of compatible technologies. That may mean that CRRC will grow its business over many years rather than quickly in the Western world, but it also means that once it gains a more decisive edge it will be even harder for competitors to take it away. More recently, CRRC won its second big US contract from Chicago.

According to Statista, prior to the merger CNR and CSR were already the two largest rolling stock manufacturers in the world. The merger expanded their market share above 50% and provides a compelling platform with which to pursue future export and international business. Scale is important in a business like rolling stock because it aids in the development of new technologies as well as in the creation of manufacturing efficiencies.

Source: Statista

CRRC has annual revenue of nearly $38 billion and net income available to common shareholders of $1.9 billion. After rallying significantly following the announcement of the merger, shares of the company have performed poorly as of late. At a price of HKD7.41, the H shares imply a market capitalization of HKD 203 billion or US$26.3 billion. That’s a multiple of less than 14 on last year’s earnings. There is also something of an arbitrage opportunity in the shares, with the A shares trading in Shanghai and the H shares in Hong Kong at vastly different prices. At a recent price of RMB 9.46, the A shares trade an equivalent of $1.44 versus the H shares at about $0.96, putting the A shares at about a 50% premium. This is a common phenomenon in the Hong Kong and Shanghai markets and one that would be difficult to assign a precise cause, although at root it is a disconnect between how Chinese investors value Chinese businesses and the rest of the world values the identical business. In Shanghai, CRRC trades at the equivalent of 22x earnings.

Very recently, the company announced a share sale worth $1.8 billion of A shares in Shanghai. The result will be an increase in the overall stake that the Chinese government holds from its current ~56%, but at a very favorable price to holders of H shares. Had the share sale gone through at the current price of H shares the company would have received about $500 million less in proceeds.

If you prefer not to purchase shares on a foreign exchange but are interested in investing, the H shares also trade over the counter with the ticker CRRRF. Very little volume trades, so reference the H share price before trading and use limit orders.

BYD (01211.HK)

BYD is the company that Li Lu is most known for investing and his 2.6% stake is currently worth about $380 million.

BYD produces batteries, handsets and cars. The company’s growth rate continues to be impressive and it continues to push innovation in extremely important areas such as energy storage and electric cars. Revenue in 2015 was $12.5 billion versus $7.2 billion in 2011. The market capitalization of BYD is currently about $15 billion and the multiple on the stock is relatively high, but the success of BYD will ultimately be in how well research and development expenses are invested. In 2015, BYD expensed an amount on research and development about equal to its net income of $450 million.

Many extremely good in depth overviews on BYD exist for those interested.

Ilsung Pharmaceuticals (003120.KS)

Ilsung is a Korean pharmaceutical company with a market capitalization of $270 million. Lu owns a 5% stake. The pharmaceutical business generated sales of $55 million and is marginally profitable. It is safe to say that the pharmaceutical business was not likely what attracted Lu to the stock.

Ilsung owns a 2% stake in Samsung C&T, the engineering and construction arm of Samsung. After Samsung C&T announced a merger with Cheil Industries at an unfavorable price, Ilsung sued saying the price was too low. Recently, a Korean appeals court sided with Ilsung. If the ruling does not get overturned, Ilsung will be owed an additional $30 million for the shares they held prior to the merger. The company also has a healthy amount of net cash. It seems that the sum of the parts is what has attracted Lu to Ilsung.

Korean Preferreds

Although we do not know what he currently owns, Lu previously gave a presentation at the Ira Sohn Conference on Korean preferreds. Preferred stock in Korea functions differently than preferred stock in US markets. It is more akin to a different class of common equity without voting rights. The family-run chaebols have issued preferred stock in order to maintain voting control of their companies.

Lu’s play (this was in 2013) was one of arbitrage, as the preferred stock was selling at a discount to the common equity. He specifically mentioned Samsung (OTCPK:SSNLF) and Hyundai (OTCPK:HYMLF). In South Korea common shares will trade with a ticker that ends in zero while preferred shares will end in a five (normally, unless it’s a second or third class of preference shares). So, for example, Samsung’s common stock trades under the ticker 005930 while the preferred stock trades under ticker 005935. Currently the preferred stock of Samsung trades at 82% of the common price while Hyundai trades at 70%. Despite the discount, the gap has narrowed since Lu recommended the preferred issues. Those considering taking advantage of the gap between common and preference shares in South Korea today may want to consider Amorepacific which is a cosmetics company with an extremely healthy business. The common shares trade under 090430 and the preferred under 090435. The preference shares are currently at 58% of the price of the common.

Lessons for Asian Investing

Taken as a whole, it is fascinating to see Li Lu apply value investing techniques in Asia in a variety of ways including the purchase of high quality companies at reasonable prices (BYD and CRRC) as well as arbitrage/workouts such as Ilsung and the Korean preferreds.

In addition to continuing to follow the moves that Li Lu makes, I think the most sensible course of action is to add some of the companies that Lu has taken note of to the list of companies that you follow. As Lu intelligently noted to students at Peking University, the periods of speculation that happen in the Chinese market make it better suited to value investors with a long-time horizon.

Using Li Lu As An Introduction To Asian Equities (OTCMKTS:BYDDF) | Seeking Alpha

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

粤ICP备2022015479号-1 All Rights Reserved © 2017-2023

粤ICP备2022015479号-1 All Rights Reserved © 2017-2023