Views: 124

What is Capital Employed?什么是已动用资本?

Capital employed refers to the amount of capital investment a business uses to operate and provides an indication of how a company is investing its money. Although capital employed can be defined in different contexts, it generally refers to the capital utilized by the company to generate profits. The figure is commonly used in the Return on Capital Employed (ROCE) ratio to measure a company’s profitability and efficiency of capital use. 已动用资本是指企业用于运营的资本投资金额,并指示公司如何投资其资金。虽然使用资本可以在不同的上下文中定义,但它通常是指公司用于产生利润的资本。该数字通常用于已动用资本回报率(ROCE)来衡量公司的盈利能力和资本使用效率。

Formula 公式

This metric can be calculated in two ways 可以通过两种方式计算此指标:

Capital Employed = Total Assets – Current Liabilities

已动用资本=总资产- 流动负债

Where 其中:

Total Assets are the total book value of all assets. 总资产是所有资产的总账面价值。

Current Liabilities are liabilities due within a year. 流动负债是指一年内到期的负债。

or 或者

Capital Employed = Fixed Assets + Working Capital 已动用资本=固定资产+营运资金

Where 其中:

Fixed Assets, also known as capital assets, are assets that are purchased for long-term use and are vital to the operations of the company. Examples are property, plant, and equipment (PP&E).固定资产,也称为资本资产,是为长期使用而购买的资产,对公司的运营至关重要。例如财产,工厂和设备(PP&E)。

Working Capital is the capital available for daily operations and is calculated as current assets minus current liabilities. 营运资金是可用于日常运营的资本,计算方式为流动资产减去流动负债。

Note: The formula chosen should be consistently applied (do not switch between formulas when conducting trend analysis or peer comparisons) as the calculation differs depending on which formula is used. Generally, total assets minus current liabilities is the most commonly used formula. 注意:所选公式应一致应用(在进行趋势分析或同行比较时不要在公式之间切换),因为计算因使用的公式而异。一般来说,总资产减去流动负债是最常用的公式。

Capital employed is very similar to invested capital, which is used in the ROIC calculation. Capital employed is found by subtracting current liabilities from total assets, which ultimately gives you shareholders’ equity plus long-term debts. Instead of using capital employed at an arbitrary point in time, some analysts and investors may choose to calculate ROCE based on the average capital employed, which takes the average of opening and closing capital employed for the time period under analysis. 已动用资本与投资资本非常相似,后者用于ROIC计算。已动用资本是通过从总资产中减去流动负债来找到的,这最终会给您股东权益和长期债务。一些分析师和投资者可能会选择根据平均已动用资本计算ROCE,而不是使用任意时间点使用的资本,该资本采用所分析时间段使用的期初和收盘资本的平均值。

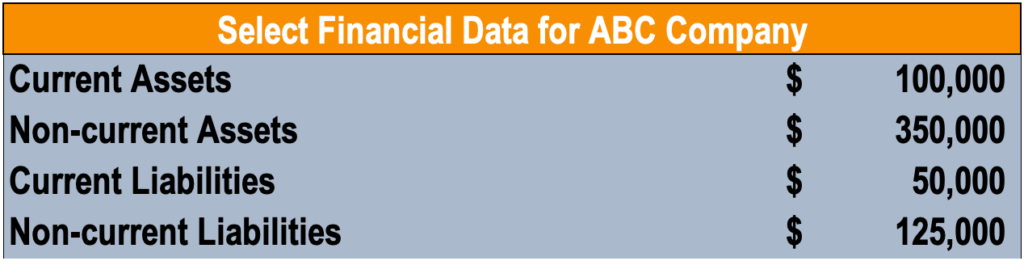

Sample Calculation

Mary is looking to calculate the capital employed of ABC Company, compiling the following information 玛丽正在计算ABC公司的已动用资本,汇编以下信息:

Using the first formula above, Mary calculates the amount as follows 使用上面的第一个公式,玛丽计算金额如下:

Capital Employed 已动用资本 = $100,000 + $350,000 – $50,000 = $400,000

Interpreting Capital Usage 解读资本使用情况

This metric provides an insight into how well a company is investing its money to generate profits. Although the figure varies depending on the formula used, the underlying idea remains the same. 该指标可以深入了解公司投资以产生利润的程度。尽管该数字因所使用的公式而异,但基本思想保持不变。

The number in itself is seldom used by analysts. It is commonly used in conjunction with earnings before interest and tax (EBIT) in the return on capital employed (ROCE) ratio. As will be explained below, ROCE is a commonly used ratio by analysts for assessing the profitability of a company for the amount of capital used. 分析师很少使用这个数字本身。它通常与已动用资本回报率 (ROCE) 比率中的息税前利润 (EBIT) 结合使用。如下所述,ROCE是分析师常用的比率,用于评估公司所用资本量的盈利能力。

Return on Capital Employed 已动用资本回报率

Return on capital employed (ROCE) is a profitability ratio that measures the profitability of a company and the efficiency with which a company is using its capital. The ROCE is considered one of the best profitability ratios, as it shows the operating income generated per dollar of invested capital. The formula for ROCE is as follows 已动用资本回报率 (ROCE) 是衡量公司盈利能力和公司使用资本效率的盈利能力比率。ROCE被认为是最好的盈利能力之一,因为它显示了每美元投资资本产生的营业收入。ROCE的公式如下:

ROCE = Earnings Before Interest and Tax (EBIT) / Capital Employed

ROCE = 息税前利润 (EBIT) / 已动用资本

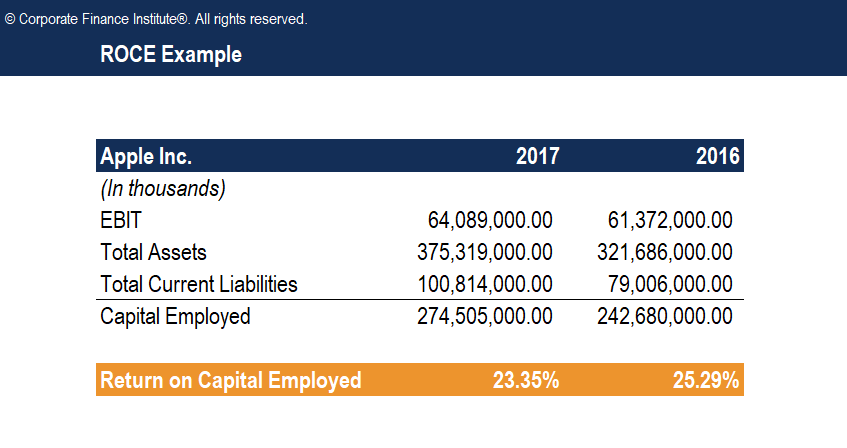

Example of ROCE

Recall that the capital employed for ABC Company in our example above is $400,000. Assuming that earnings before interest and taxes figure of ABC Company is $30,000, what is the ROCE? 回想一下,在我们上面的例子中,ABC公司使用的资本是400万美元。假设ABC公司的息税前利润为000,30美元,那么ROCE是多少?

ROCE = $30,000 / $400,000 = 0.075 = 7.5%

For every dollar of invested capital, ABC Company generated 7.5 cents in operating income.对于每一美元的投资资本,ABC公司产生了7.5美分的营业收入。

Here is a screenshot of the template 以下是模板的屏幕截图 :

Source: Capital Employed – Definition, Formula, and Sample Calculation (corporatefinanceinstitute.com)

粤ICP备2022015479号-1 All Rights Reserved © 2017-2023

粤ICP备2022015479号-1 All Rights Reserved © 2017-2023